Service Design applied to mortgages

Applying user center methodologies to the mortgage process

Client

Volksbank

Date

2017-18

My responsibilities

I was part of a service design team made of 3 people. I focused mainly on the interview part with the customers and on the construction of the personas and customer journeys.

We reported to the Chief Strategy Officer of the bank.

It is quite common for a bank to want to improve the sell rate of mortgages. A bank that wants to do this through service design and design thinking techniques created an opportunity for me to apply these methodologies to improve such an important process as requesting a mortgage.

The process

01. Building the personas

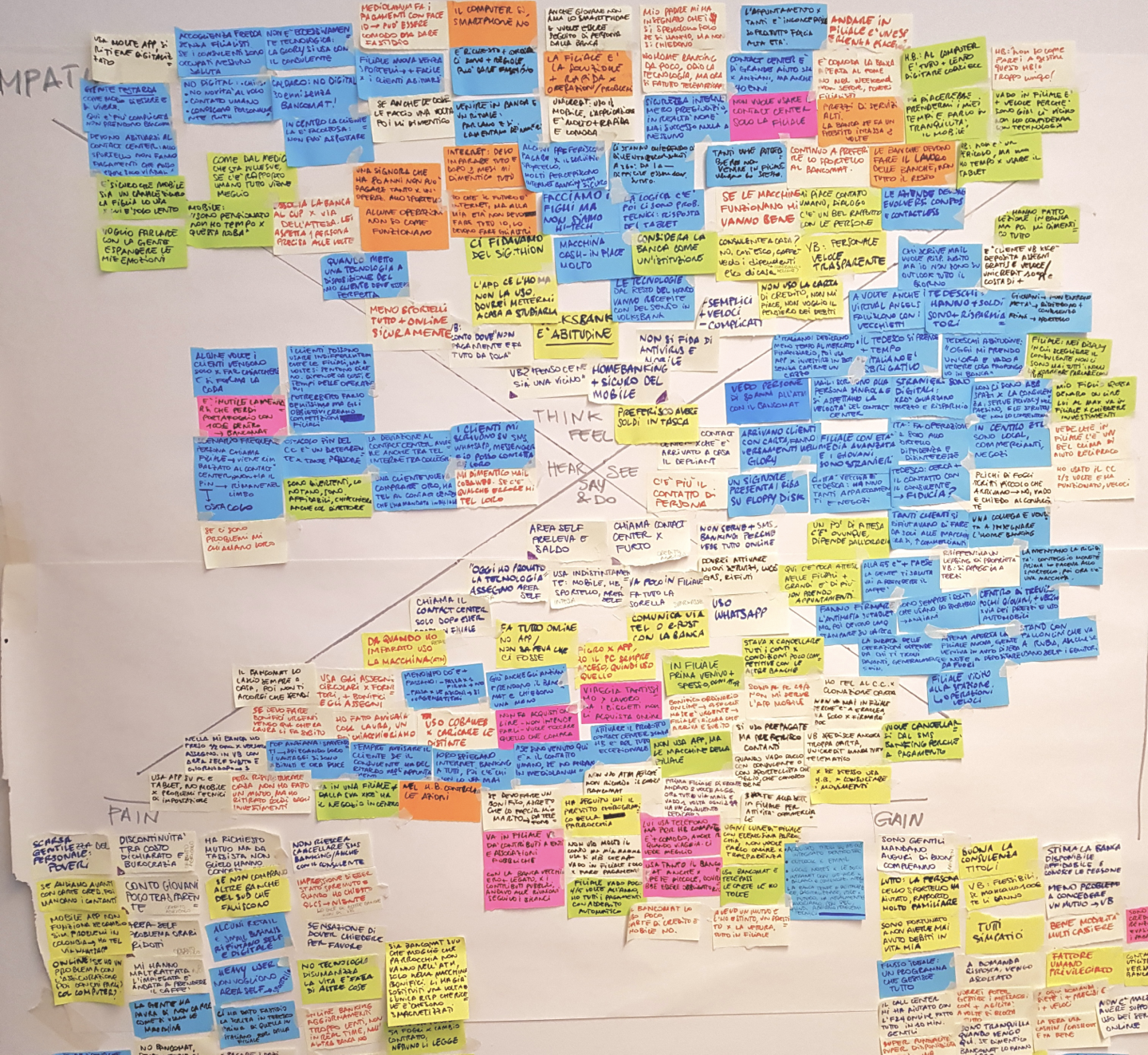

In order to build some reliable personas, we conducted more than 100 qualitative interviews, analyzed lots of quantitative data, did on-field observation, interviewed customers, non-customers and employees working in branches.

We used also a big empathy map to merge all the insights coming from the user research.

02. Customer journey and emotional journey

To map the as-is process we used a customer journey that was enriched by the user’s feedback acquired during the research phase.

The customer journey took in consideration a very wide period: from the user’s first thought to buy or to construct the house to the full repayment of the mortgage.